The AI platform for

crypto trading

Arbitra watches 200+ markets around the clock, identifies high-probability setups, and executes adaptive strategies autonomously.

No spam, ever. Be the first to get access.

Trading on leading exchanges

Platform

The trading intelligence

infrastructure for crypto

Beneath every trade, a symphony of real-time analysis powers decisions with precision.

AI Trading Agent

Reads market structure like an experienced trader, detecting regime shifts and adjusting strategy in real-time

Adaptive Grid Engine

Dynamic position management that adapts spacing, sizing, and targets to live market conditions

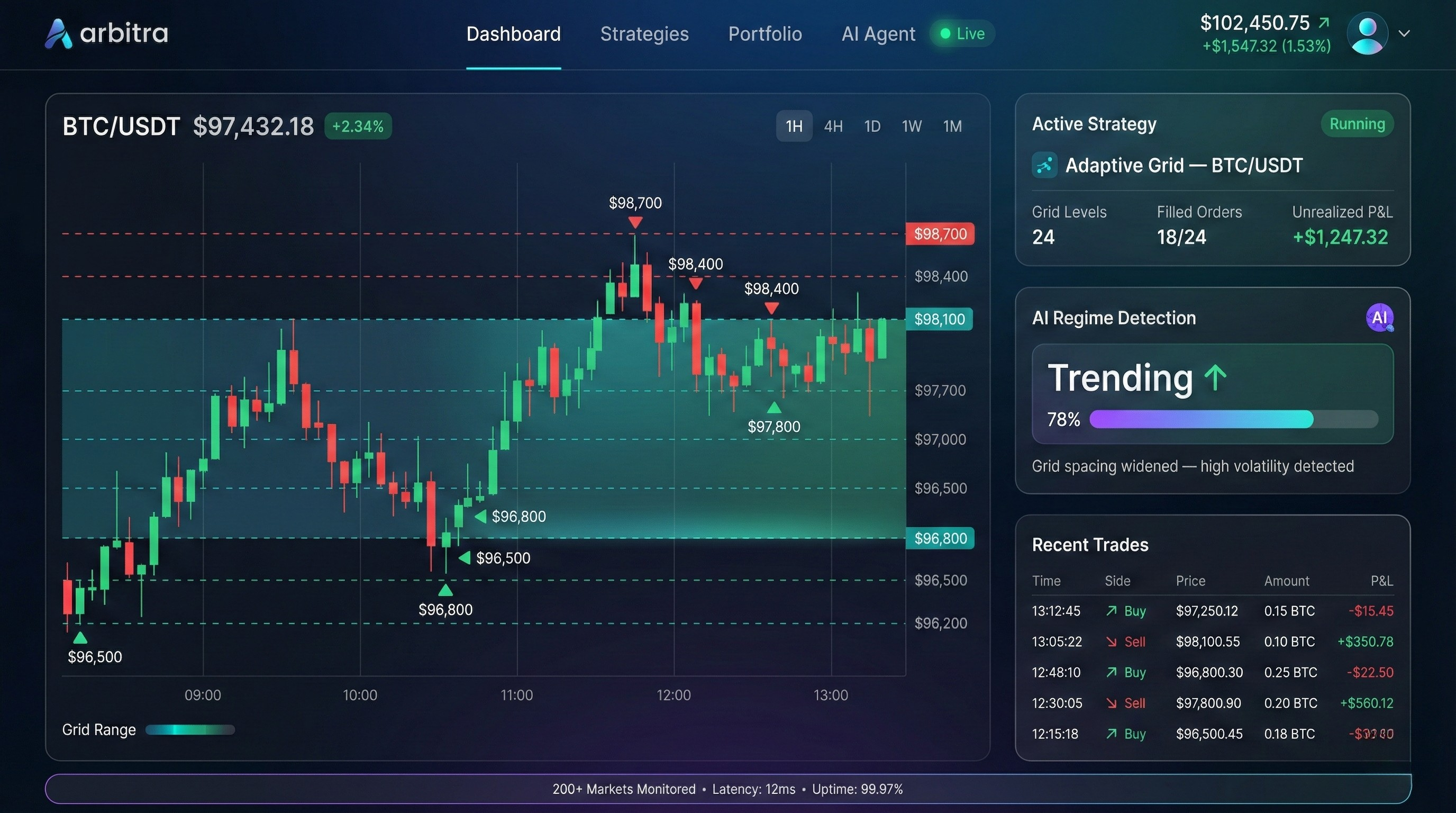

Live Dashboard

Real-time WebSocket feeds showing every position, P&L tick, and trade across all active strategies

Risk Management

Per-trade stop-losses, drawdown circuit breakers, and position limits enforced without exception

Dashboard

Your command centre

Every signal, every trade, every decision — visible at a glance. Built for clarity under pressure.

Under the hood

Three systems working

in concert

Most trading tools give you one thing. Arbitra orchestrates intelligence, execution, and protection as a single system — each layer informing the others in real time.

Reads the market like a strategist

Our AI doesn't just follow indicators — it builds context. It reads regime shifts, detects volatility contractions before breakouts, and selects strategies the way an experienced trader would: by understanding what kind of market it's looking at.

- Regime detection across trending, ranging & volatile states

- Backtested strategy selection, not random parameter guessing

- Continuous learning from every trade outcome

Precision at every price level

Grid trading works because markets oscillate. Our engine places and manages hundreds of orders across dynamic price levels — adjusting grid density, position sizing, and spread in response to live conditions, not static parameters.

- Adaptive grid levels that respond to volatility in real time

- Sub-second order management across multiple exchanges

- Smart position sizing based on conviction & risk budget

Survival is the first alpha

Every profitable system eventually faces a black swan. Arbitra's protection layer runs independently — monitoring drawdown, correlation spikes, and liquidity gaps. It can freeze execution in milliseconds, before damage compounds.

- Per-strategy circuit breakers with automatic cool-down

- Portfolio-level drawdown limits with instant position flattening

- Anomaly detection for flash crashes & liquidity voids

From setup to first trade

Define your rules

Connect your exchange, set your risk tolerance, and choose which markets to trade. Arbitra respects your boundaries — it operates within the limits you set, never beyond them.

Let the engine work

The system continuously scans for opportunity — analyzing regime, volatility, and market structure. When conditions align with a proven strategy, it deploys capital automatically.

Compound your edge

Every trade feeds back into the system. Performance data refines strategy selection, risk parameters self-adjust, and the AI adapts to evolving market conditions. Your edge sharpens over time.

Performance

The numbers speak

for themselves

Based on backtested results and live paper trading data. Past performance does not guarantee future results.

FAQ

Common questions

Start trading with

an unfair advantage

Join the early access and explore what AI-powered

crypto trading looks like.

No spam, ever. Be the first to get access.